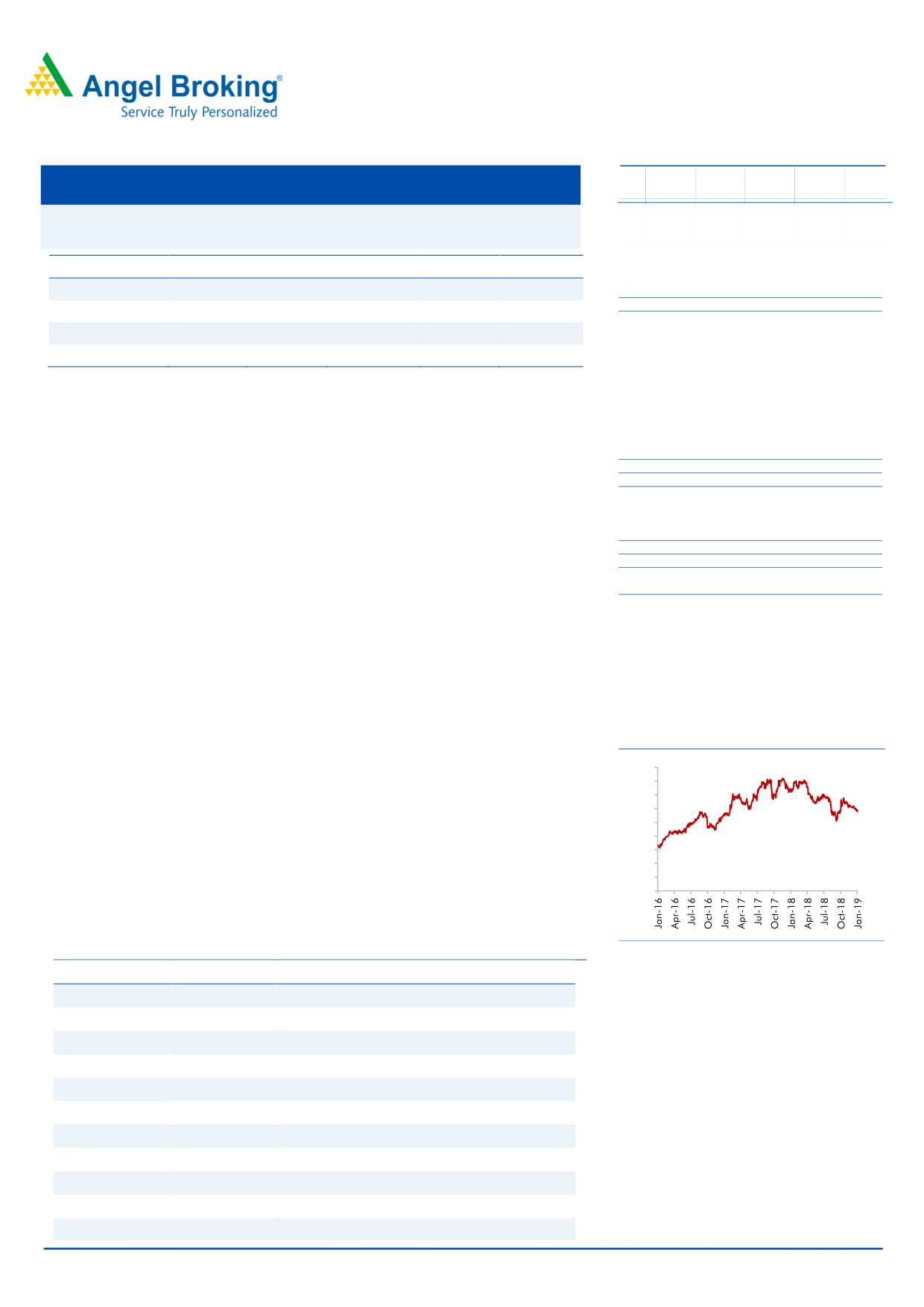

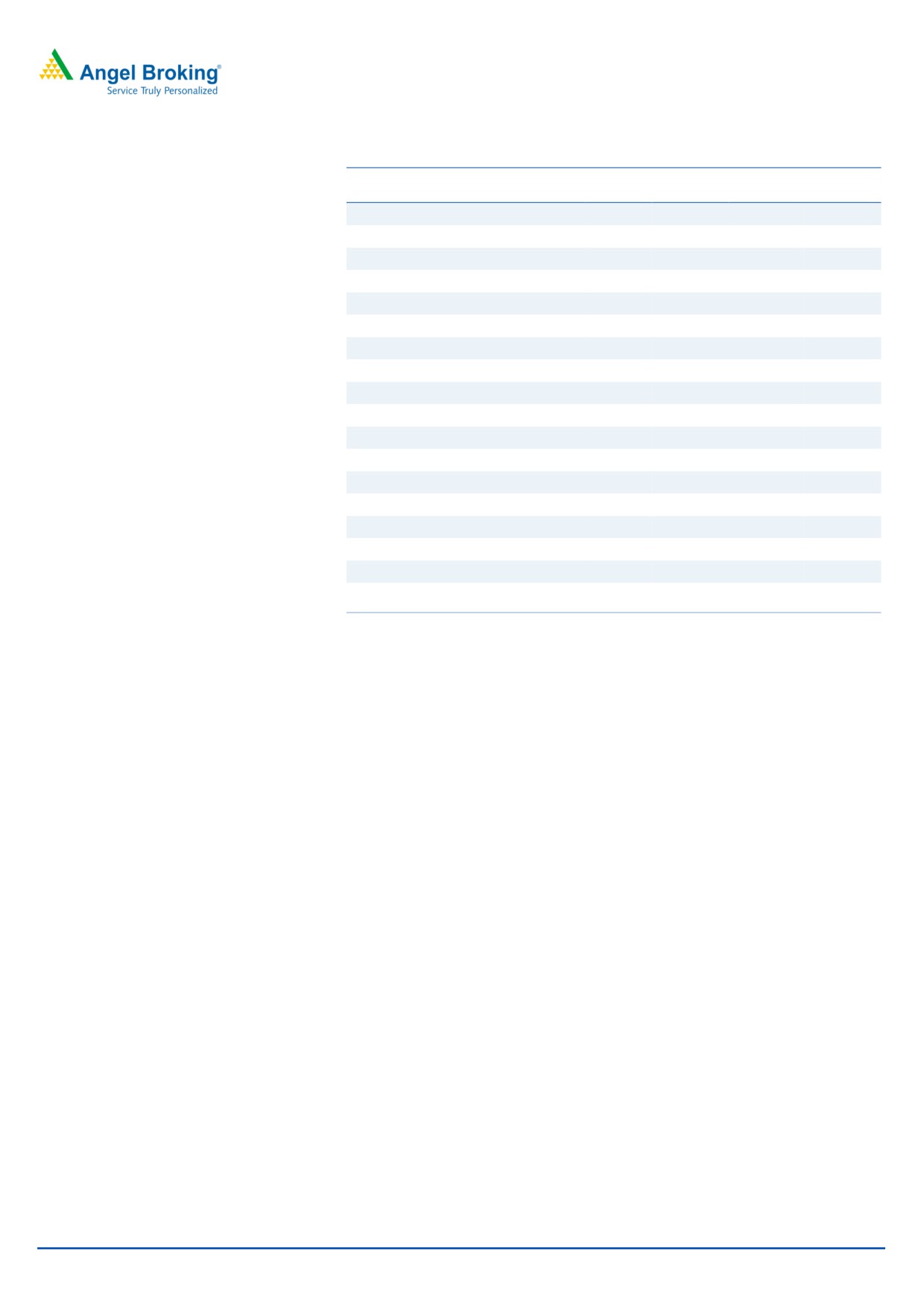

3QFY2019 Result Update | Cons. Durable

February 14, 2019

Blue Star Ltd

BUY

CMP

`589

Performance Update

Target Price

`867

3QFY19

3QFY18

% chg. (yoy)

2QFY19

% chg. (qoq)

Investment Period

12 Months

Net Sales

1,099

932

17.9

1,032

6.5

Stock Info

Operating profit

35

42

(17.1)

58

(39.4)

Sector

Cons. Durable

OPM (%)

3.2

4.6

(135bp)

5.6

(243bp)

Market Cap (` cr)

5,605

Net Debt (` cr)

210

Adj. PAT

4

13

(69.8)

23.8

(83.0)

Beta

0.2

52 Week High / Low

843/507

Source: Company, Angel Research

Avg. Daily Volume

18,198

Face Value (`)

2

For 3QFY2019, Blue Star posted results below our expectations on the bottom-line front.

BSE Sensex

35,876

Nifty

10,746

The company reported ~18% yoy top-line growth, whereas PAT was down ~70% yoy due

Reuters Code

BLUS.BO

to losses in JV and higher interest cost.

Bloomberg Code

BLSTR IN

Strong revenue growth across segments boosted top-line: The company’s top-line grew

Shareholding Pattern (%)

Promoters

38.8

~18% yoy at `1,099cr on the back of strong performance in EMP business (up ~16% yoy)

MF / Banks / Indian Fls

22.1

FII / NRIs / OCBs

10.2

driven by the increased pace of execution of projects, and a pick-up in the central air

Indian Public / Others

29.0

conditioning business, especially chillers and VRF systems. Further, the revenue of Unitary

Abs.(%)

3m

1yr

3yr

Products business increased by ~22% yoy due to strong growth in deep freezers and

Sensex

2.5

5.5

53.0

Blue Star

3.1

(20.5)

75.6

storage water coolers in the commercial refrigeration business coupled with growth in the

air coolers and water purifiers businesses. Sales grew in the RAC segment by ~8% yoy, thus

increasing the market share to ~12.5%. Professional Electronics and Industrial Systems

business’ revenue grew~16% yoy during the quarter.

Adj. PAT de-grew ~70% yoy: On the operating front, the company’s margins contracted by

135bps yoy on the back of weak margin in the UCP segment due to increasing pricing

3-year price chart

pressure and higher consumer financing cost. The bottom-line registered de-growth of

900

~70% yoy to `4cr on account of higher interest cost (`14.5cr) and losses in International

800

JV.

700

600

Outlook & Valuation: We forecast Blue Star to report top-line CAGR of ~12% to `5,871cr

500

400

over FY2018-20E on the back of healthy demand growth in Air Conditioning and Unitary

300

Products division. On the bottom-line front, we estimate ~17% CAGR to `198cr owing to

200

100

improvement in volumes and better operating margins. We maintain our Buy

0

recommendation on Blue Star with a Target Price of `867.

Key Financials

Source: Company, Angel Research

Y/E March (`cr)

FY2017

FY2018

FY2019E

FY2020E

Net Sales

4,385

4,648

5,178

5,871

% chg

13.5

6.0

11.4

13.4

Net Profit

123

144

135

198

% chg

12.2

17.0

(6.1)

46.1

Amarjeet S Maurya

OPM (%)

5.1

5.7

6.1

6.3

022-39357800 Ext: 6831

EPS (Rs)

12.8

15.0

14.1

20.6

P/E (x)

46.0

39.3

41.8

28.6

P/BV (x)

7.5

6.9

6.5

6.0

RoE (%)

16.3

17.7

15.6

20.8

RoCE (%)

16.5

17.0

19.6

22.0

EV/Sales (x)

1.3

1.3

1.1

1.0

Please refer to important disclosures at the end of this report

1

Blue Star Ltd | 2QFY2019 Result Update

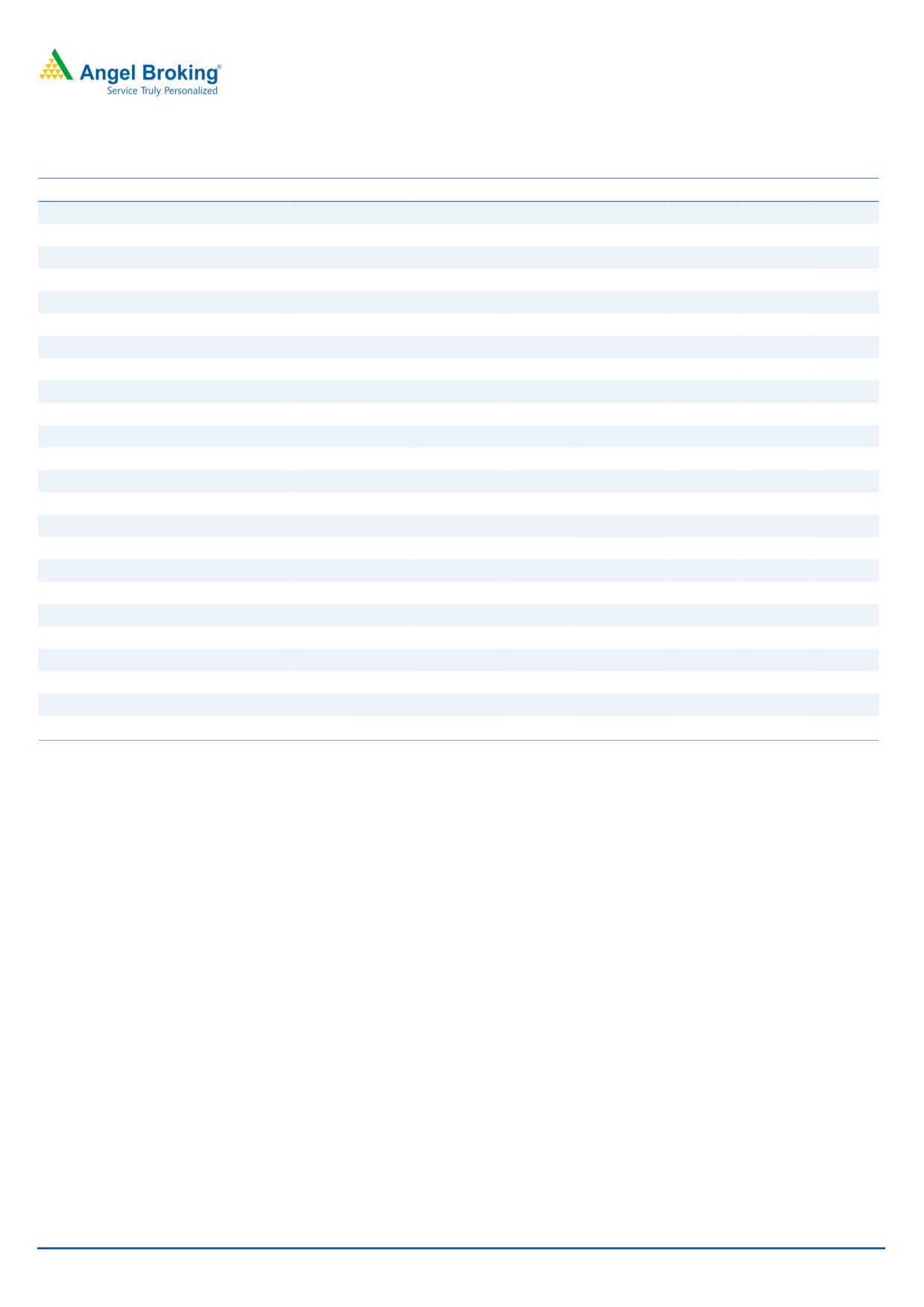

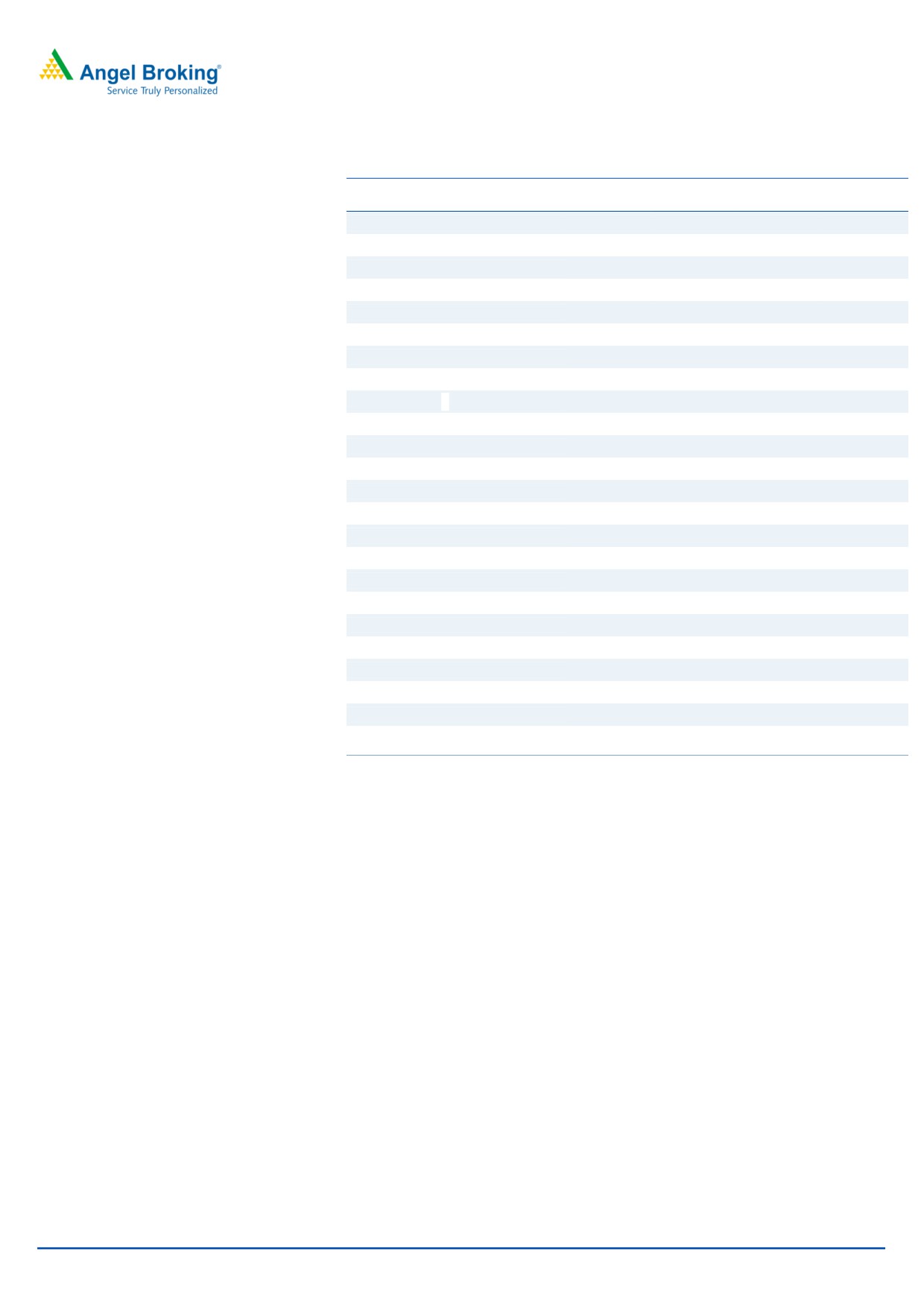

Exhibit 1: 3QFY2019 Performance

Y/E March (` cr)

3QFY19

3QFY18

% chg. (yoy) 2QFY19

% chg. (qoq)

9MFY19

9MFY18

% chg

Net Sales

1,099

932

17.9

1,032

6.5

3,639

3,293

10.5

Net raw material

837.7

678

23.6

704.7

18.9

2733

2450.5

11.5

(% of Sales)

76.2

72.7

350

68.3

795

75.1

74.4

Employee Cost

107

101

5.2

106

0.7

312

290

7.7

(% of Sales)

9.7

10.9

(117)

10.3

(55)

8.6

8.8

Other Expenses

120

110

8.2

164

(26.9)

357

351

1.7

(% of Sales)

10.9

11.9

(97)

15.8

(497)

9.8

10.7

Total Expenditure

1,064

890

19.6

974

9.2

3,402

3,091

10.1

Operating Profit

35

42

(17.1)

58

(39.4)

237

201

18

OPM (%)

3.2

4.6

(135)

5.6

(243)

6.51

6.12

40

Interest

13

7

78.2

12

12.3

37

18

104.5

Depreciation

18

17

5.9

17

7.9

51

46

12.5

Other Income

10

4

191.3

5

110.3

24

17

43.4

PBT

14

21

(33.7)

34

(58.8)

173

155

11.8

(% of Sales)

1.3

2.3

(43.8)

3.3

4.8

4.7

Exceptional Items

(2.7)

Tax

1

6

(83.0)

8

(87.4)

41

41

0.4

(% of PBT)

7.0

27.2

22.8

23.9

26.6

Reported PAT before MI & Extra Ord. Items

13

16

(15.3)

24

(44.7)

132

113

16.0

PATM

1.2

1.7

2.3

3.6

3.4

Minority Interest

0

0

(4)

0

0

P/L of Ass. Co.

(14)

(2)

(4)

(21)

(1)

Extra-ordinary Items

5

(0)

(4)

0

Reported PAT

4

13

(69.8)

24

(83.0)

107

112

(5.0)

Source: Company, Angel Research

February 14, 2019

2

Blue Star Ltd | 2QFY2019 Result Update

Key investment arguments

Cooling Products division - the backbone of growth: Company is estimating more

than 20% growth (outperforming the market at 15-20% growth) in FY2019E in the

cooling products division. Further, considering the strong growth in last summer,

the market is expected to be further driven by the rise in demand over the coming

months.

Newer products and strong demand to aid overall profitability: Blue Star is

planning to add two brand new models to its RAC product range in FY2019,

having four models currently. The company is planning to launch one high wall-

cordless split AC model around the same time. Moreover, increase in demand

from large government related infra projects like metro and some small segments

from hospitals and educational institutions will also boost sales.

Wide distribution network: Blue Star has a strong presence in the South and West

regions of India and is now planning to increase its presence in North. Hence, the

company has already increased its dealer count and is taking steps to improve per

dealer output in Northern region. Moreover, Bluster Silicones, an overseas

subsidiary of China National Bluster (Group) signed a distribution agreement with

Grasim Industries in India for its whole series of silicone products in an attempt to

expand its distribution network in India and increase its market share.

February 14, 2019

3

Blue Star Ltd | 2QFY2019 Result Update

Outlook & Valuation:

We forecast Blue Star to report top-line CAGR of ~12% to `5,871cr over FY2018-20E on

the back of healthy demand growth in Air Conditioning and Unitary Products division. On

the bottom-line front, we estimate ~17% CAGR to `198cr owing to improvement in volumes

and better operating margins. We maintain our Buy recommendation on Blue Star with a

Target Price of `867.

Downside risks to our estimates

Any slowdown in consumer segments like IT/ITES, healthcare, hospitality and

infrastructure could impact the company’s growth.

Foreign exchange fluctuations have a direct impact on the profit of the cooling

products division since commercial refrigerators are imported.

The RAC industry has been witnessing high traction and the company has

been able to outperform the industry over the past few years. Any unexpected

drop in performance of the RAC industry would pose a threat to our estimates.

Company Background

Blue Star Limited is an air-conditioning and commercial refrigeration company.

The company conducts various activities, such as electrical, plumbing and fire-

fighting services. Its segments include Electro-Mechanical Projects and Packaged

Air Conditioning Systems, and Unitary Products. The Electro-Mechanical Projects

and Packaged Air-Conditioning Systems segment includes central air-conditioning

projects, electrical contracting business and packaged air-conditioning businesses,

including manufacturing and after sales service. The Unitary Products segment

includes cooling appliances, cold storage products, including manufacturing and

after sales service. The company's products include central air conditioning, room

air conditioners and speciality cooling products. Its other businesses include

marketing and maintenance of imported professional electronic equipment and

services, as well as industrial products and systems, which is handled by Blue Star

Engineering & Electronics.

February 14, 2019

4

Blue Star Ltd | 2QFY2019 Result Update

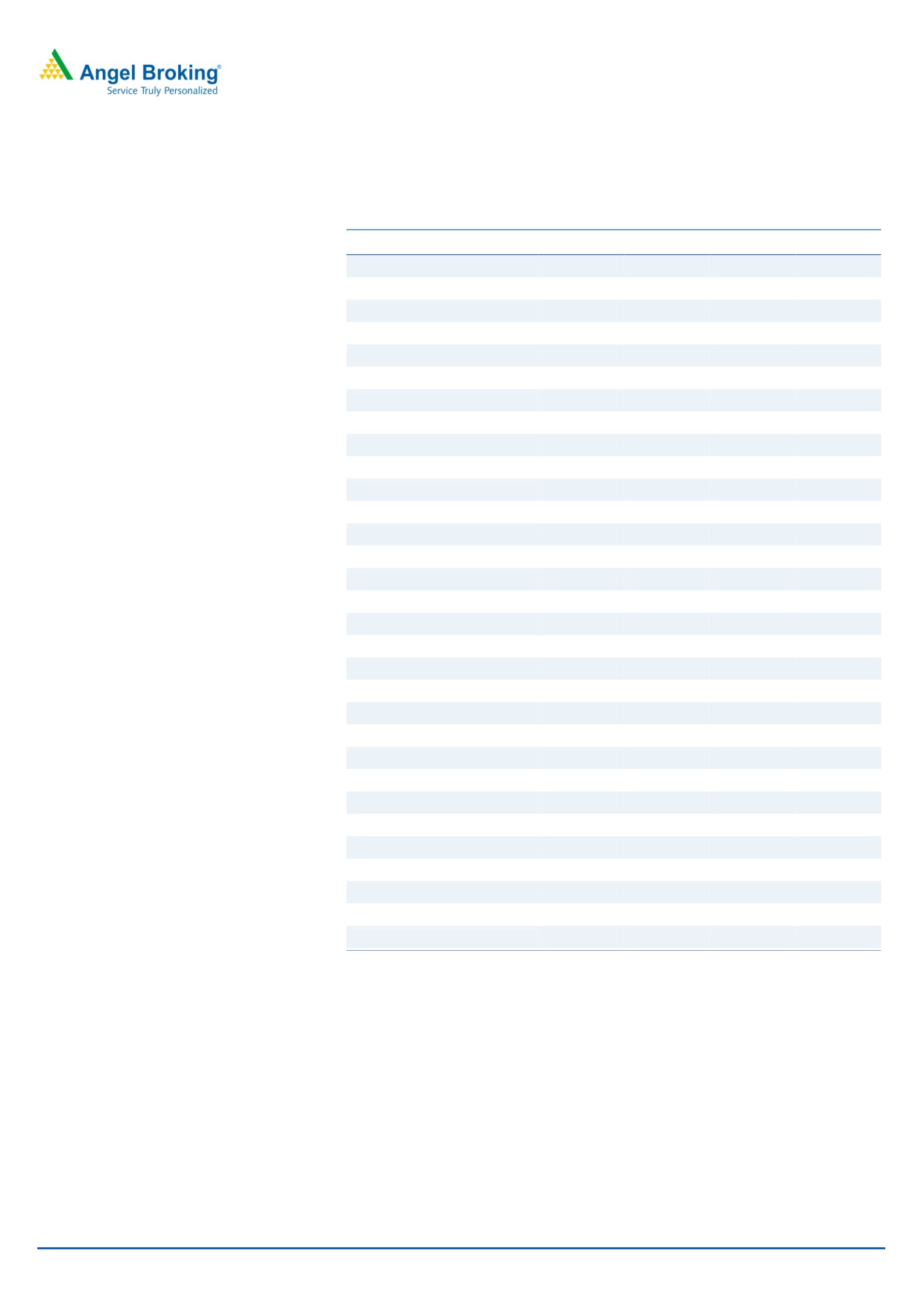

Consolidated Profit & Loss Statement

Y/E March (` cr)

FY2017

FY2018

FY2019E

FY2020E

Total operating income

4,385

4,648

5,178

5,871

% chg

13.5

6.0

11.4

13.4

Total Expenditure

4,163

4,382

4,862

5,501

Raw Material

3,112

3,229

3,526

3,992

Personnel

339

398

445

517

Others Expenses

712

756

891

992

EBITDA

222

266

316

370

% chg

39.0

19.6

18.8

17.1

(% of Net Sales)

5.1

5.7

6.1

6.3

Depreciation& Amortisation

61

64

71

78

EBIT

162

202

245

292

% chg

57.2

24.9

21.2

19.1

(% of Net Sales)

3.7

4.3

4.7

5.0

Interest & other Charges

38

29

50

40

Other Income

35

17

29

22

(% of PBT)

21.8

8.9

12.9

8.0

Share in profit of Associates

-

-

-

-

Recurring PBT

159

190

224

274

% chg

19.7

20.0

17.7

22.2

Tax

37

49

60

74

(% of PBT)

23.1

26.0

27.0

27.0

PAT (reported)

122

141

164

200

Minority Interest (after tax)

0

0

0

0

Profit/Loss of Associate Company

1

2

24

2

Extraordinary Items

-

5

4

-

ADJ. PAT

123

144

135

198

% chg

12.2

17.0

(6.1)

46.1

(% of Net Sales)

2.8

3.1

2.6

3.4

Basic EPS (`)

12.8

15.0

14.1

20.6

Fully Diluted EPS (`)

12.8

15.0

14.1

20.6

% chg

12.2

17.0

(6.1)

46.1

February 14, 2019

5

Blue Star Ltd | 2QFY2019 Result Update

Consolidated Balance Sheet

Y/E March (`cr)

FY2017

FY2018

FY2019E

FY2020E

SOURCES OF FUNDS

Equity Share Capital

19

19

19

19

Reserves& Surplus

738

796

850

929

Shareholders Funds

757

815

869

948

Minority Interest

1

1

1

1

Total Loans

221

371

380

380

Deferred Tax Liability

24

24

24

24

Total Liabilities

1,004

1,211

1,274

1,354

APPLICATION OF FUNDS

Gross Block

359

399

439

479

Less: Acc. Depreciation

72

135

206

284

Net Block

288

264

233

195

Capital Work-in-Progress

34

34

34

34

Investments

79

79

79

79

Current Assets

2,141

2,425

2,719

3,049

Inventories

596

815

922

1,046

Sundry Debtors

939

1,019

1,135

1,287

Cash

97

81

134

147

Loans & Advances

390

394

414

458

Other Assets

120

116

114

112

Current liabilities

1,670

1,732

1,903

2,113

Net Current Assets

471

693

816

937

Deferred Tax Asset

132

132

132

132

Mis. Exp. not written off

-

-

-

-

Total Assets

1,004

1,211

1,274

1,354

February 14, 2019

6

Blue Star Ltd | 2QFY2019 Result Update

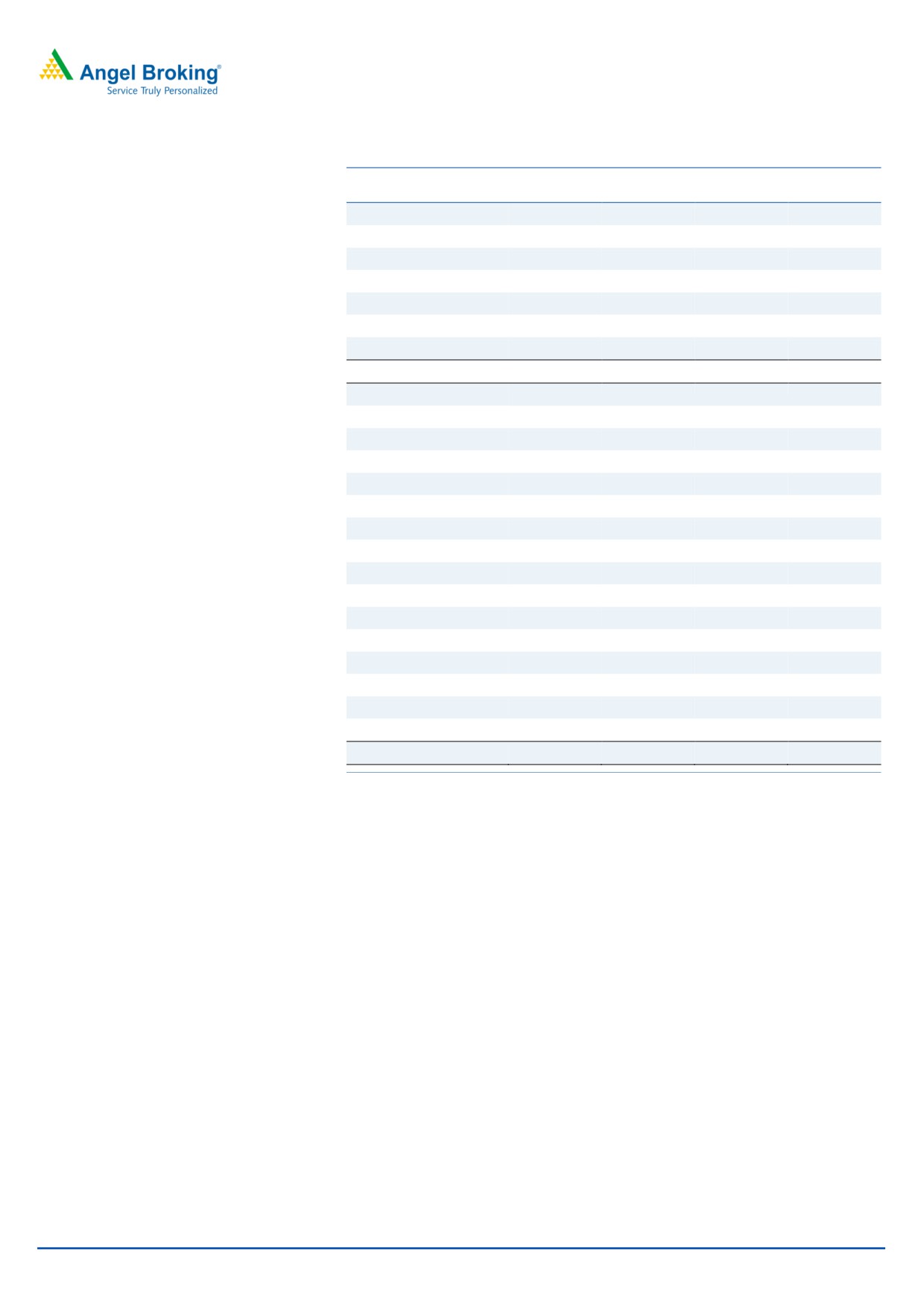

Consolidated Cash flow Statement

Y/E March (`cr)

FY2017

FY2018

FY2019E FY2020E

Profit before tax

159

190

224

274

Depreciation

61

64

71

78

Change in Working Capital

(105)

(238)

(70)

(107)

Interest / Dividend (Net)

19

29

50

40

Direct taxes paid

2

(49)

(60)

(74)

Others

(26)

0

0

0

Cash Flow from Operations

159

(4)

214

211

(Inc.)/ Dec. in Fixed Assets

(107)

(40)

(40)

(40)

(Inc.)/ Dec. in Investments

177

0

0

0

Cash Flow from Investing

69

(40)

(40)

(40)

Issue of Equity

7

0

0

0

Inc./(Dec.) in loans

6

150

9

0

Dividend Paid (Incl. Tax)

(2)

(86)

(81)

(119)

Interest / Dividend (Net)

(185)

(7)

(49)

(39)

Cash Flow from Financing

(174)

57

(121)

(158)

Inc./(Dec.) in Cash

54

12

53

14

Opening Cash balances

15

68

81

134

Closing Cash balances

68

81

134

147

February 14, 2019

7

Blue Star Ltd | 2QFY2019 Result Update

Key Ratios

Y/E March

FY2017

FY2018

FY2019E

FY2020E

Valuation Ratio (x)

P/E (on FDEPS)

46.0

39.3

41.8

28.6

P/CEPS

31.0

27.6

24.1

20.3

P/BV

7.5

6.9

6.5

6.0

Dividend yield (%)

1.3

1.5

1.4

2.1

EV/Sales

1.3

1.3

1.1

1.0

EV/EBITDA

25.6

22.1

18.4

15.7

EV / Total Assets

5.7

4.9

4.5

4.2

Per Share Data (`)

EPS (Basic)

12.8

15.0

14.1

20.6

EPS (fully diluted)

12.8

15.0

14.1

20.6

Cash EPS

19.0

21.3

24.4

29.0

DPS

7.5

9.0

8.5

12.3

Book Value

78.9

84.9

90.5

98.7

Returns (%)

ROCE

16.5

17.0

19.6

22.0

Angel ROIC (Pre-tax)

20.2

19.7

23.7

26.5

ROE

16.3

17.7

15.6

20.8

Turnover ratios (x)

Asset Turnover (Gross Block)

12.2

11.6

11.8

12.2

Inventory / Sales (days)

50

64

65

65

Receivables (days)

78

80

80

80

Payables (days)

98

95

93

90

Working capital cycle (ex-cash) (days)

30

49

52

55

Source: Company, Angel Research

February 14, 2019

8

Blue Star Ltd | 2QFY2019 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National Commodity &

Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and Investment Adviser with

SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered entity with SEBI for Research

Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not

been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its

associates/analyst has not received any compensation / managed or co-managed public offering of securities of the company covered

by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Disclosure of Interest Statement

Blue Star

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

Reduce (-5% to -15%)

Sell (< -15%)

February 14, 2019

9